IIJA…NTIA…BEAD…NOFO…fiber-first…extremely high-cost thresholds. Well, that’s a mouthful. Ever since the Infrastructure Investment and Jobs Act (IIJA) was passed in the Fall of 2021, these terms have been swirling in and out of our collective newsfeeds continuously. And we get it, at this point you’re probably beginning to develop a case of “funding fatigue.” But we hope that you will stay positive and keep pushing forward – there’s mounting evidence that all technologies – beyond only fiber – will be considered in BEAD-funded rural broadband expansion projects. Because the reality is, in many of these circumstances, wireless and hybrid networks continue to prove to be a strong choice for rural, remote, and tribal lands.

And because we are so confident in these rural broadband options, we decided to investigate a few real-life, all-fiber deployments of the recent past – their total project costs, costs per household/businesses passed, and population densities – and compare these against our own wireless and hybrid design approximations, getting them as close to real-life as possible. We were inspired by the study which you may have seen recently from Tarana Wireless, and thought we’d like to add some additional perspective to the conversation.

A [VERY] BRIEF BREAKDOWN OF BEAD

But first, here’s our BRIEF breakdown of the Broadband Equity, Access, and Deployment (BEAD) rural broadband funding program, for context. The U.S. government’s got a bunch of money set aside to hand out to the States ($42B to be exact), who will then award individual BEAD program applicants within their State as they see fit, and according to pre-defined guidelines.

We’re guessing you’ve also heard that these guidelines for who should be awarded the grants are also…well…complicated.

There are no two ways about it…there are certainly some strings attached to this money, one of which is the National Telecommunications and Information Administration’s (NTIA) notice of funding opportunities (NOFO) language which defines fiber as the preferred technology for use in BEAD-funded deployments. And while we understand the good intentions behind these guidelines, we also know that fixed wireless and hybrid networks can offer excellent connectivity at a fraction of the costs and deployment times of fiber. These are two important considerations that should not be taken lightly when there’s so much at stake – primarily, getting the unserved and underserved populations of the U.S. connected quickly and affordably.

THE “FIBER-FIRST” LANGUAGE

Fiber-first and to-the-premises in far out, remote locations, you say? Hmm, we’re just not sure how that’s going to work. Again, while we agree with the NTIA that these areas need and deserve high-speed, reliable rural broadband connections to enable them to participate fully in the digital age, we think specifying that fiber-to-the-premises must always be considered first is not only impractical and costly, but unfeasible to complete in a timely manner. And we think this is a belief we share with many in the industry. In fact, a study originally published in Heavy Reading, “Bridging the Digital Divide,” shows that 78% of operators say that less than 50% of their underserved regions’ digital divide challenges will be solved using fiber-to-the-home, versus other technologies.

So what’s with the fiber-only guidelines?

It seems that sometimes when attempting something monumental – like closing the digital divide – large entities (like federal governments) can have the best intentions, and sometimes not necessarily foresee how too many stipulations might hinder progress, rather than enable it. In this case, the U.S. government nobly wants the broadband community to help get our friends in rural, remote, and tribal communities connected and able to participate in today’s digital economy. And the wireless community is more than ready to step up. In fact, we cannot wait to show off what we can do! For many of us in wireless, we’ve been doing this for years…decades even. So let’s collectively get this thing done.

STUDIES AND [GIGANTIC] ESTIMATES

If you’re in this business, you’ve probably seen various studies come out recently – a few from industry associations and another from Tarana Wireless – “Achieving US Digital Divide Goals with 100% Fiber Would Require ~5x the Available Funds.” This one estimates that it will cost upwards of $200 billion to deploy a full-fiber approach to serve the ~16 million households currently defined as unserved or underserved by the FCC, or about 5x the $42 billion available today through the BEAD program.

Ok…

So even if you believe $200 billion might be a bit hyperbolic – and let’s agree on something, we do not – we DO know there’s no way we’re getting this thing done…under the fiber-to-the-premises guidelines…for $42 billion.

ANOTHER LOOK

Because Tarana’s study already provided some great analysis on a macro level, we thought we’d get a little more in the weeds and take a closer look at some side-by-side comparisons, for context.

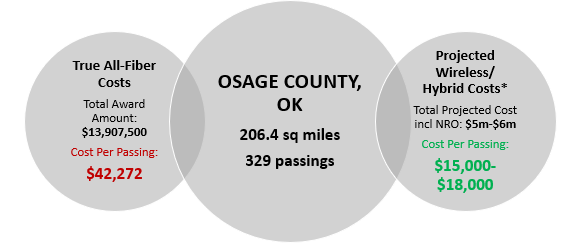

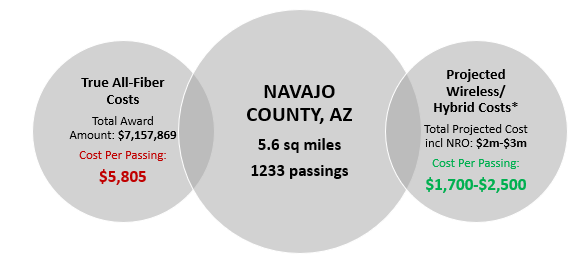

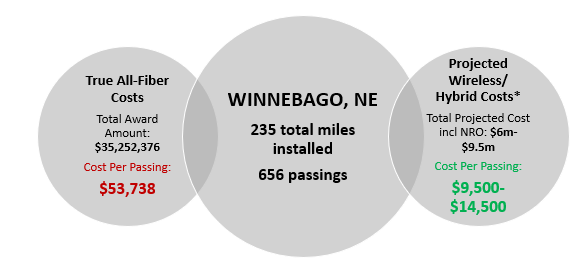

We looked at publicly available data from several rural broadband programs of the past and selected three sample project awardees with plans to deploy all fiber to the premises – one project in Osage County, Oklahoma, one in Navajo County, AZ, and another in Winnebago, NE.

We based our projected wireless/hybrid network cost comparisons against the available data of the above rural fiber projects, such as each one’s 1) location, 2) total square mileage covered, or total miles of fiber installed, 3) The number of funded service area homes/businesses/passings, 4) total awarded amount (including any provider match), and 5) any additional details that were included in the grant disclosures. Our engineers then used this data to develop a hypothetical network plan that either used all wireless technology or a hybrid approach to connectivity.

We do not think anyone in the broadband business will be surprised by the estimated cost differences** we found. But here they are…

*Projected wireless/hybrid costs are estimated based on an assumptive solution that includes: 5-mile coverage per CBRS base station and 2 miles Wi-Fi base station – 85% CBRS plus 15% Wi-Fi access. The backhaul is composed of 50% fiber and 50% microwave (licensed and licensed exempt) platforms. Network rollout (NRO) estimates are also included in these numbers.

So what makes up the higher costs of the all-fiber deployments?

- Population density, and the distance from point A to point B. No matter the form, it’s expensive to trench, micro trench, and string aerial fiber optic cabling. And the further you must go, the more money it’s going to cost you.

- “Make ready costs,” or securing rights-of-way, franchises, conduit leases, property leases, or pole attachments (think railroad crossings, bridges, state/city/county line crossings, etc.) for fiber.

- Permitting costs such as municipal/government permits, licenses, or authorizations prior to construction.

- Overcoming challenging terrain such as mountains, rivers, or forests. Again, one size does not fit all when it comes to network design.

- Rollout and construction costs. For all-fiber deployments, you are going to need:

- Experienced crews/labor, which are not always easy to come by

- Materials/equipment

- Trenching/digging and their cost here also fluctuates depending on depth or height

- Time to install: Fiber takes much longer to install than wireless. Longer time to market = longer time to add subscribers and therefore, revenue.

OUR CONCLUSIONS

While we understand the NTIA’s reasons for making fiber a priority (it’s a good technology, after all), we cannot help but point out that the original goal of the U.S. Congress’ 2021 Bipartisan Infrastructure Law was to reach 100% of American households with fast and affordable internet service. Mandating a one-size-fits-all technology approach and applying that to an entire country of vastly different terrains, population densities, rules and regulations, is an oversimplification of this problem at best, and could be a huge, costly mistake at worst.

It is our hope that as the States begin to see the long delays and exorbitant costs of a fiber-only approach to bridging the digital divide, the fiber-first guidelines will begin to loosen. Fiber is an excellent technology – there’s no question about that – but fixed wireless and hybrid solutions deserve their day in the sun too. We give fiber its due credit in another recent blog, “Fiber & Wireless: Come Together to Bridge the Digital Divide,” but we do think one technology should not be given preference over another.

Wireless and hybrid solutions provide:

- Multi-gigabit capacity, with speeds ranging from 10 Mbps to 650 Mbps

- Easy & quick installation – getting our rural communities connected within days, not months or years like fiber

- Dependability – while fiber optic cabling is traditionally viewed as the more reliable choice, it is susceptible to construction damage, water, ice, rodents, you name it. You can’t cut wireless!

- Low latency – many people don’t realize that fiber latency is quite a bit higher than wireless. Read more in another one of our blogs, “Fiber vs Fixed Wireless – Who Wins in 2023?.”

- And finally, much lower costs. The current average cost of laying fiber has reached $60,000 to $80,000 per mile, conservatively. Wireless can be deployed at a fraction of this cost.

SUMMARY

We will admit that applying for grants and proposing hybrid network designs to close the digital divide has not been an easy road so far. But we’re asking all our friends out there not to give up hope. As time goes on, we have a feeling that things will begin to turn around. Fixed wireless internet is here to stay. So go ahead and propose those hybrid solutions when it is the best solution for the job. We’re right here and ready to help wherever you might need us in the grant applications process.

**The costs shared in the comparison exercise are approximations based on the limited publicly available FCC data and a number of assumptions regarding each individual project. These are being shared as demonstration purposes and should not be treated as price quotes or guarantees. This article is to be distributed for awareness-raising purposes. For specific project pricing, please contact Ceragon Networks.

IIJA GRANT FUNDING - STILL HAVE QUESTIONS?