5G promises to bring disruption to the mobile industry. Such disruption will shake the mobile ecosystem as we know it, and will affect vendors and service providers.

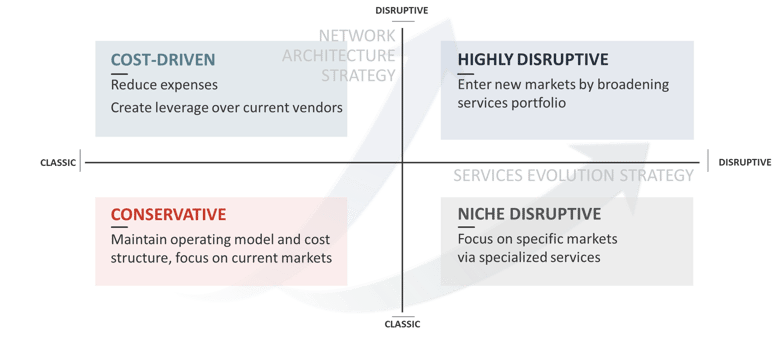

To understand how this will affect you as an operator, it is important to understand the different levels and dimensions of the disruption. And there’s no better way to visualize this than by using a 2x2 matrix diagram.

Let’s create this matrix by first setting up two axes – the services evolution strategy axis and network architecture strategy axis. Each of these axes ranges from a classic approach to a disruptive one:

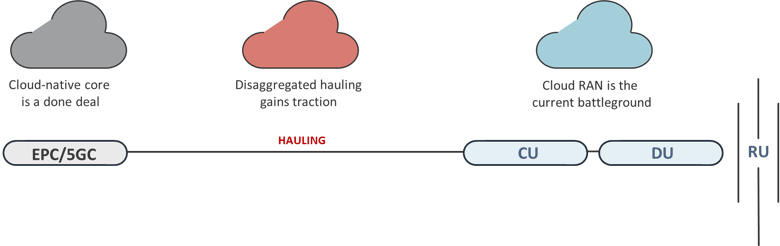

The network architecture strategy axis illustrates the high levels of openness, flexibility and disaggregation that are available when building 5G infrastructure. Cloud-native and disaggregated solutions exist in all network domains – the core, the hauling (including backhaul, midhaul and fronthaul) and the RAN.

It seems that disaggregated, cloud-native solutions in the core are a done deal. Solutions from incumbent vendors and newcomers are based on cloud architecture, which you will find in almost any 5G deployment today.

The hauling domain also shows growing traction to open disaggregated solutions, which are also promoted by the Telecom Infra Project (TIP).

The real battleground is in the RAN, where you can find both classic monolithic solutions and open cloud-native solutions, from different vendors.

In the RAN, you can leverage horizontal disaggregation, in which you break the “classic” eNodeB (or rather gNB) to three functional elements – the central unit (CU), the distributed unit (DU) and the radio unit (RU). This allows cost efficiency (mainly thanks to the simplicity of the RUs, which are massively introduced in 5G), flexibility in deployment, and better coverage and service at the cell edge (thanks to better resource management and adjacent cell coordination).

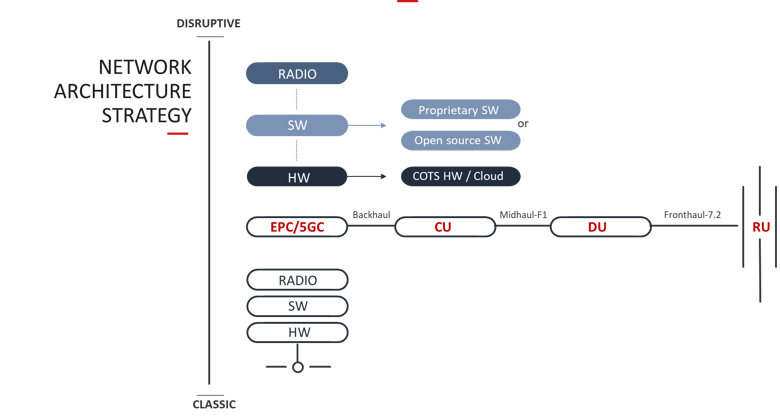

On top of that, there is the option for vertical disaggregation. As opposed to the monolithic approach, where the hardware, software and radio elements are proprietary, in the open disaggregated approach each element is a stand-alone standard entity. So the networking hardware is based on merchant silicon (i.e. white-box hardware), the software can come from any vendor (or even be acquired as open source), and the radio (at a much later stage) may also be semi-open in architecture.

According to the O-RAN Alliance, all elements in the RAN network (including the radio) can be based on a cloud instance (virtual server), which acts as the standard hardware.

If we want to illustrate those options on the network architecture strategy axis, it looks like this:

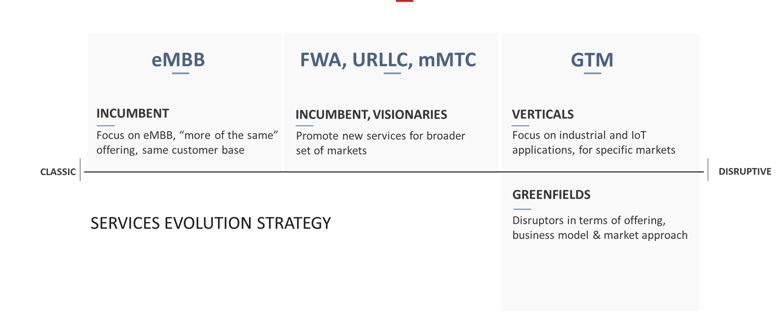

On the operation/service axis, the disruption is based on the wide span of new services and use cases offered by 5G (e.g. eMBB, mMTC, FWA and URLLC). These allow existing and new operators to address new market segments with new service offerings and new go-to-market (GTM) strategies.

The classic operation model will serve traditional incumbent/existing service providers. They will focus on eMBB services (“more of the same”, compared to 4G) and will approach their existing customer base only.

Other leading/visionary incumbents will promote new services and use cases to address new target audiences.

Greenfield 5G operators will have to be disruptive in terms of go-to-market strategies and service offerings.

Lastly, niche players will address specific markets, typically a vertical market like industry with some non-eMBB offering. There we may find some non-typical players.

Now that we have described the full matrix, let’s analyze the meaning of each of the four quadrants, and which operators we would expect to find in those quadrants.

First, let’s name the different quadrants:

- Conservative – these operators use a classic network architecture to deliver classic services

- Cost-driven – these leverage disruptive architecture with the main target of cost reduction

- Niche disruptive – such operators approach only a specific segment of the market with new types of offerings, but usually use classic architecture as a solution

- Highly disruptive – these leverage a disruptive architecture to promote new services, use cases and go-to-market strategies

Finally, it is interesting to analyze and evaluate which types of operators will we find in each quadrant of the 5G disruption matrix.

The conservative quadrant will be occupied by incumbents that will launch 5G without significant vision in terms of architecture, service offerings or target markets.

More visionary incumbents will move to the cost-driven or the highly disruptive quadrants. If cost-driven, they will implement new network architectures for the main purpose of cost reduction. If highly disruptive, they will implement some combination of a new type of offering (e.g. FWA or IoT) or new go-to-market strategy. We might find some of those visionary incumbents in the niche disruptive quadrant as well.

New players, such as Siemens and Bosch, will focus on specific segments of the market (e.g. Industry 4.0) and will typically be found in the niche disruptive quadrant.

Surprisingly enough, we will find greenfield operators (actually, there are only two of those currently – Japan’s Rakuten and DISH Network in the US) in the highly disruptive quadrant. This is the case even though one might expect inexperienced operators to choose classic well-proven solutions from an end-to-end supplier. The fact that we find those greenfield operators engaged with disruptive modern architecture provides evidence to the maturity and benefits of the disruptive approach.

Lastly, there are new types of operators – the “carrier-of-carrier” providers. These are the cloud infrastructure providers (e.g. Amazon Web Services, Microsoft Azure and Google Cloud), some of which are making bold moves into the 5G arena (see Microsoft’s latest moves to acquire Affirmed Networks and Metaswitch Networks).

These cloud providers are not equivalent to network solution vendors. Rather they provide infrastructure, processing power, capacity, latency and geographic coverage – all “as a service” to operators – and therefore may be considered as a new type of carrier-of-carriers.

So, which quadrant of the 5G disruption matrix are you in now? Which should you be in? I will leave this analysis to the reader.

To learn more about building flexible and open architectures for 5G