This post was recently updated in June 2023

The transition from 4G to 5G terrestrial wireless access will require a corresponding increase in backhaul capacity to support the growing network traffic requirements.

Dell’Oro Group’s recent forecast report on mobile backhaul transport predicts steady growth over the next three years thanks to 5G network expansion in locations that favor wireless backhaul, with more than $5.3 billion in sales by 2025.

“Demand for wireless backhaul is on the rise,” said Jimmy Yu, VP of Dell’Oro Group. “Early in the 5G deployment cycle, the main backhaul technology used was fiber-based, resulting in five solid years of fiber backhaul revenue growth. Going forward, we expect more of the 5G deployments to take place in locations without accessibility to fiber as well as in countries that traditionally favor wireless backhaul systems, driving a lot more growth for Microwave Transmission equipment in the future.”

For the top 30 markets, 5G mobile subscriptions are expected to increase from nearly 400 million to over 4 billion subscribers between 2021 and 2027, with 5G accounting for over 80% of total traffic by the end of the period.

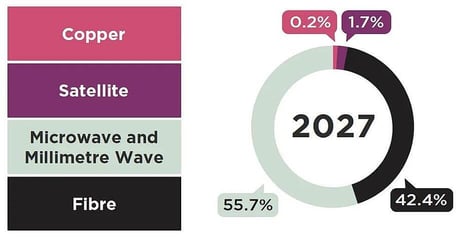

The GSMA report on Wireless Backhaul Evolution addresses many aspects of this transition. In this blog we will focus on their conclusion that fiber and wireless are complementary technologies, and that both are expected to play a major role in meeting backhaul requirements for many years to come.

In general, service providers deploy a combination of fiber and wireless backhaul solutions. Both fiber and wireless are valid solutions and key for the deployment of 5G networks. The hybrid backhaul infrastructure offers the greatest value to mobile network operators. Wireless backhaul and fiber backhaul technologies differ in most of their parameters. Yet, both are aimed at achieving the same goal – creating a transport infrastructure to accommodate the current and future needs of the 5G networks by means of capacity, latency, and availability.

The GSMA projection that the majority of backhaul links will still be covered by wireless solutions until 2027 (traditional Microwave bands and Millimeter wave bands) raises questions about this forecast since fiber enjoys significant capacity and throughput advantages compared to wireless hauling.

When exploring the two technologies, there is a need to examine them in light of additional relevant parameters, such as time-to-market, reliability, flexibility, scalability, and cost efficiency.

- Reliability

Fiber is vulnerable to fiber cuts if not deployed in a redundant architecture and suffers from failures caused by backhoe and post hole diggers, and other earth-moving equipment. The typical reliability of fiber or dark fiber without redundancy is “three 9’s “(99.9%). Leased lines under SLAs that ensure alternate routes in case of failure provide “four 9’s” (99.99%) reliability.

Wireless links can be engineered to provide "five 9's" (99.999%) reliability, using various techniques such as adaptive code modulation (ACM), adaptive power control, space diversity, and more.

In fact, many businesses which plan to deploy fiber, or already have existing fiber infrastructure, install microwave as a backup to fiber to mitigate the risk of communications loss and minimize downtime.

- Flexibility and Scalability

Fiber and dark fiber (with third-party dependencies) are highly scalable and very easy to upgrade and practically have a limitless capacity of up to 1 Tbps.

Wireless solutions are highly scalable, and their capacity is very easy to upgrade. Their future capacity limit is 100 Gbps, with wide bands of up to 5 GHz.

- Time-to-Market

A major weakness of fiber solutions is time-to-market. It is very time consuming to deploy and commission fiber, since it requires the acquisition of rights of way and work permits. This can take months or even more when dealing with large infrastructure.

Conversely, wireless transmission is very quick to deploy, which makes it possible to rapidly increase market share. Assuming that the necessary frequencies and equipment are available, microwave links can often be installed within days and become operational within a week, which reflects a time-to-market advantage of over 95%.

- Cost Efficiency

Cost efficiency presents another major challenge when introducing fiber infrastructure. Fiber requires a large one-time investment. With dark fiber, there is a large one-time fee, as well as recurring fiber lease costs. Both options result in significant Capital (CAPEX) and Operational (OPEX) expenditures over time.

While the additional time involved in fiber deployments has a direct correlation to higher OPEX costs, of equal importance is the tangible CAPEX savings that microwave equipment holds over most optical equipment. In fact, our studies show that for an equivalent speed/bandwidth, microwave transport enjoys at least a 60% cost advantage over optical transport endpoints. In some use cases, depending on the geographical zone and network architecture, the microwave cost advantages can reach up to 90%!

The GSMA report mentioned earlier makes five key policy recommendations for regulators based on the GSMA’s research findings:

- Regulators must recognize microwave and millimeter backhaul as a critical component of national-level Information and Communication Technology (ICT) strategy.

- Regulators need to be realistic and recognize that license fees that scale linearly with channel sizes serve as large financial burdens for operators. They should also incentivize spectrally efficient methods.

- There must be a regulatory push toward wider channel sizes to support 5G.

- The E-band will play an especially important role in all markets in the 5G era.

- Regulators should consult the industry to make the D-band and W-band available when needed.

To summarize, in the early stages of 5G planning, fiber infrastructure was considered to be the sole, or at least the most favorable, infrastructure to rely on. But now that operators have looked more closely at the advantages of wireless backhaul solutions – flexibility and scalability, reliability, time-to-market, and cost efficiency – microwave has asserted itself as a legitimate 5G transport contender.

Ceragon’s unique wireless backhaul technologies provide highly reliable, high-capacity solutions with minimal use of spectrum and power. This provides increased network efficiency as well as simple and quick network deployment towards 5G networks.

For more information, download our white paper on E-BAND MILLIMETER WAVE FOR TELECOM